After several years of low inventory and high demand, the local housing market is taking a step toward a more “normal” environment.

“It has been such a super intense market. Everything moved at such a fast pace,” said Marsha Ross, a local broker with John L. Scott. “It’s balancing out a little more now, which is better for everyone.”

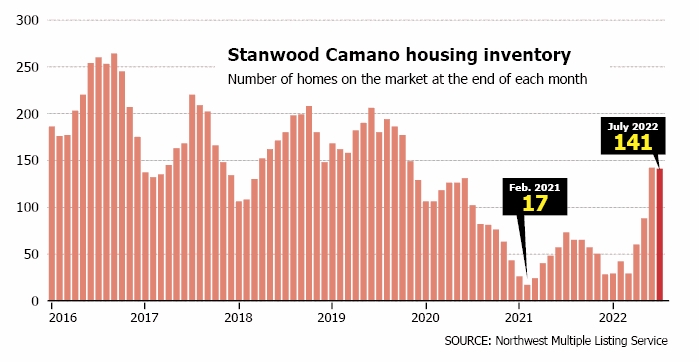

In the Stanwood-Camano area, there were 141 homes on the market in July — about double from a year ago.

However, the tight market of the past few years never seemed to dampen sales, which held steady at around 100 per month in the summertime during the past five years. It meant buyers had fewer choices and more competition when making offers.

“It’s been such a unique two years,” said Marla Heagle, broker and co-owner of Windermere Stanwood Camano. “It seems like everyone is slowing to take a breath finally.”

In the white-hot local market of the past few years, it was common to see a home listed on a Thursday with offers reviewed on Monday, she said. Most homes, when priced right, would see multiple, aggressive offers, she said.

“So far this summer, the prices just aren’t escalating as fast. But we’re still seeing multiple offers here and there,” Heagle said.

On Camano, the median price of the 34 homes sold in July was $601,000, down slightly from $615,000 a year ago, according to data from the Northwest Multiple Listing Service.

In Stanwood, the median price of the 68 homes sold was a record $730,000, up from $575,000 a year ago, according to the Northwest MLS.

Local home prices have risen dramatically as the region kept working over the past decade to climb out of the Great Recession. In July 2016, the median price of homes sold on Camano was $280,000 and in Stanwood was $347,000.

Bob Wold, broker and co-owner of Re/Max Elevate in Stanwood, said he expects the market to continue trending toward normal.

“The last few years were unprecedented,” Wold said. “With the world in COVID and inventory levels shrinking to levels we’ve never seen before, there’s no other word for it than unprecedented. But I’m happy to see it moving toward a balanced, healthy market. That’s what’s best for both buyers and sellers.”

Across Western Washington in July, there were fewer sales, but prices still rose, albeit at a slower rate than the previous year. The median price on last month’s closed sales of single-family homes and condos increased 6.1% from a year ago, rising from $589,000 to $625,000 in Western Washington.

In the four-county Puget Sound region, price changes ranged from a gain of about 2.7% in King County (from $789,000 to $810,000) to a jump of nearly 12.7% in Pierce County (from $501,500 to $565,000). Kitsap prices rose 5.4% while prices in Snohomish County increased 9.3%.

Inventory of single-family homes and condominiums across the 26 counties served by Northwest MLS has not exceeded two months since January 2019 when there was 2.3 months of supply. But in July, data showed 2.01 months of inventory across Western Washington.

“Today’s buyers have their cups finally overflowing with options as residential inventory grows to about two months of supply,” Dick Beeson, managing broker at RE/MAX Northwest Realtors in Gig Harbor, said in a Northwest MLS news release. “Buyer and seller expectations have changed. It feels like things are starting to normalize a little.”

Both Heagle and Ross, who sell homes in the Stanwood-Camano area, said the houses sold here are to a wide variety of people, from young families to retirees.

“About 50% of my clients have been young families,” Ross said. “We also get a lot of people looking to retire here from Seattle.”

Heagle echoed those observations.

“The demographics here are getting younger,” she said. “At the same time, the typical buyer doesn’t want a property with a lot of maintenance. They’re asking for a smaller yard, bigger views and access to things like parks.”

Those who changed to working from home during the COVID-19 pandemic are seeking home office space and a reliable internet connection, Heagle added.

Meanwhile, the Federal Reserve recently raised short-term interest rates to fight inflation, which in turn pushes rates higher for credit cards, auto loans and mortgages.

Nationwide, those rising mortgage rates have combined with already high home prices to discourage some would-be buyers. Mortgage applications have declined sharply. Across the U.S., sales of previously occupied homes have fallen for five straight months, during what is generally the busiest time of year in real estate.

However, the local economy “remains buoyant, which is an important factor when it comes to the regional housing market, particularly as it affects buyers,” Matthew Gardner, chief economist for Windermere Real Estate, wrote in his quarterly housing report. “Even though the number of homes that came to market has jumped significantly, which should favor those looking for a new home, demand is still robust, and the market remains competitive.”

Locally, home construction companies are building “at a monumental rate” while trying to adjust to increases in mortgage rates, John Deely, executive vice president of Coldwell Bank Bain, said in a Northwest MLS news release.

“We are seeing builders moving their price points down and providing incentives to buyers in closing costs and buydowns to help borrowers obtain lower interest rates.” Deely said. “We are coming off the fevered pitch of a market that had tremendous velocity over the last few years. With listings starting to build again we are seeing a bit of a natural slowdown, yet still very much a sellers’ market.”

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link