First-Time Home Buyers!

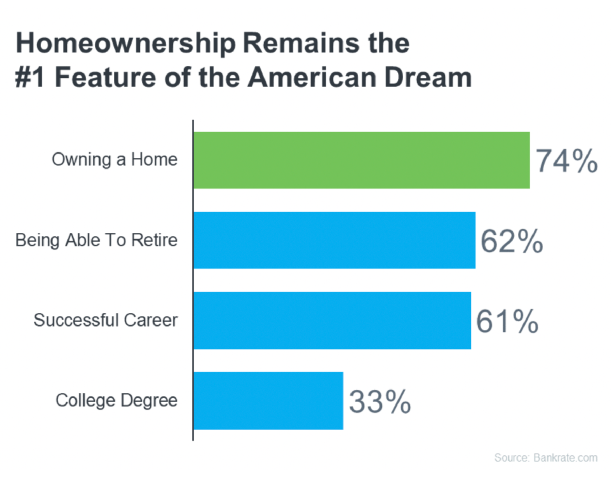

As beauty is in the eye of the beholder, the idea of the American Dream differs from person to person. However, in a recent Bankrate study, participants were asked which accomplishments best embodied the American Dream. According to the results, owning a home continues to rank highest for many Americans today (see graph below):

Let's accept that homeownership is still important to the younger generation. Why is there such a widespread belief that owning a home is such an unattainable feat for first-time buyers?

(Believe it or not, we disagree with your Grandpa, who says the $15 a week you spend at Starbucks is holding you back from entering the world of home ownership.)

For starters, there’s a myth out there, particularly among first-time home buyers, that you need to come up with a down payment of 20% or more of the price to purchase a home. This couldn’t be further from the truth. In fact, the most common way first-time-buyers get into a home is by utilizing a low-down payment program:

- FHA Loan

3.5% down payment and a minimum credit score of 580. Backed by the Federal Housing Administration.

- Conventional 97

3% Minimum Down payment. From Freddie Mac or Fannie Mae, around a 620 minimum credit score.

- VA Loan

For veterans or active-duty service members. NO down payment is required. Generally, a credit score of around 620 is required.

Tips For First-Time Buyers

- Monitor your credit, and work to improve

The higher your credit score, the better the interest rate on your mortgage. This means you should be periodically checking your credit score and working to improve it. Ideally, you'd like your credit utilization ratio to be between 20-30% (the amount of revolving credit you're using divided by the total credit available to you). Of course, you'll also want to make sure you're paying off all bills on time.

- Aim to avoid financing any new purchases prior to starting your home

The amount you can borrow will depend on how much you owe. Your loanable amount is decreased if you finance a significant new purchase (a new automobile, for example) before applying for a mortgage. Making a big purchase could also have a negative effect on your credit score because it will decrease your available credit and increase use. That might affect the terms of a house loan, including the interest rate.

- Get pre-approved

We mentioned low-down-payment loan options; there's nobody better to explore loan options with than a reputable mortgage broker. For instance, compared to conventional loans, an FHA loan for first-time home purchasers permits lower qualifying credit scores and a smaller down payment. On the other hand, a traditional loan can have fewer limitations. Working with a knowledgeable loan officer who can find the loan that best suits your circumstances is crucial.

- Look for down payment assistance programs

Numerous local, regional, and federal down payment assistance and first-time homebuyer programs are available to help with closing expenses and your down payment. These programs can place a cap on the price of the home and are usually only available to borrowers whose income falls below a given threshold (depending on their location).

Multiple state housing finance agency mortgages, intended for first-time homebuyers and those with low to moderate incomes, are paired with several of these programs.

- Work with a reputable real estate broker

In our humble opinion, the most crucial step is to work with a good Real Estate Agent. When looking to hire a broker, it’s critical to work with someone who is exceptionally knowledgeable about the area you're trying to buy in. Look for a dedicated broker/team who studies the market and gives you accurate advice on market conditions, who can help determine if the properties you want to make offers on are priced appropriately. You want to look for someone who will negotiate and advocate on your behalf during price and terms negotiations and who can advise you throughout the process. Working with a competitive agent can increase your chances of winning multiple offer situations on a home you love, as they understand the art of an offer and can craft a clean contract that gives you a leg up.

As brokers who are recent first-time buyers ourselves, we understand the ins and outs of the process, the difficulties, and the workarounds on what to look for to get into your first home. With the right guidance, homeownership may be more attainable than you think… If owning a home is your goal, do not hesitate to reach out to us at DeBoer Brothers Real Estate Team to learn more, get the process started looking for your first home, and begin building wealth through real estate.

To look at active homes on the market, read more about us, and learn about the benefits of home ownership, visit our website at: DeBoerBrothersRealEstate.com

Written by Karl & Trygve DeBoer

Real Estate Brokers

Windermere Stanwood & Camano Island

deboerbrothers@windermere.com

360-593-6220